In its recent Going for Growth report, the OECD concludes that the economic and financial crisis will leave an unwelcome legacy: a permanent reduction in economic activity. This loss averages about 3% of potential GDP across the 20 member countries for which the OECD was able to make these estimates.

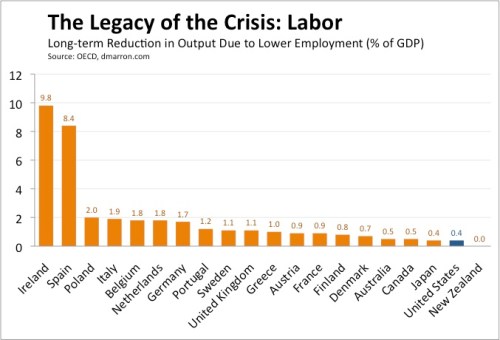

As the following chart shows, those losses differ greatly across countries:

Ireland and Spain are the clear losers, with the crisis cutting economic activity by more than 10%. Despite being a catalyst for much (but by no means all) of the crisis, the United States faces one of the smallest losses. The 2.4% reduction in potential U.S. GDP is a sobering hit, but is less than that faced by 16 of the other nations.

Why does the United States appear to be on track for comparatively moderate output losses? Because of its resilience.

Remember that word “resilience”? It used to be a standard talking point when discussing the U.S. economy before the financial crisis. At the time, many economic observers were impressed with the economy’s ability to rebound from repeated shocks: terrorist attacks, corporate scandals, tech bubbles, wars, oil price shocks, etc.

That talking point understandingly fell by the wayside during the depths of the crisis. But it remains relevant as the economy moves into recovery, at least according to OECD’s analysis.

The OECD based its estimate of long-term output losses on two factors: a permanent reduction in employment and a permanent increase in the cost of capital. Given the global nature of capital markets, it shouldn’t be surprising that the cost of capital effect does not vary much among nations and that the United States falls right in the middle:

The big differences come in employment:

These estimates reflect both the size of the negative shocks that countries experienced (with Ireland and Spain clear outliers) and historical relationships about the persistence of unemployment in the various countries. Because of its comparatively flexible–and therefore resilient–labor markets, unemployment has been less persistent in the United States than in most other OECD nations, particularly those in Europe. That’s why the OECD expects the United States to bear lower long-run costs from the crisis than most other nations.

Donald,

Are those figures for loss of GDP truly “permanent” in the sense of some enduring magnitude, or just a present value measure that reflects lower GDP for many years but eventual narrowing of the gap (to less than each given loss figure) vs. the previously (pre-crisis) projected long-term path, or perhaps even eventual elimination of that gap?

Hi Brooks — These figures are intended to represent a shift downward in potential GDP. The one thing I can’t tell precisely from the OECD report is how long they think this will persist. In the space of two page, they refer to this as a decline in “medium-term potential”, a decline in “potential output over the long term”, and as a “permanent GDP loss.” My best guess is that it’s intended as a prolonged but not literally permanent decline in the level of potential GDP.

thanks

thanks Donald